Growth and challenges of eCommerce in Brazil

BeOn Brasil 13 MAY 2019Brazil is now going through a recovery and its economy is starting to grow again. The trust of consumers and the industry is high and important progresses are being made in one of the most dynamic sectors of the economy: the digital world. Nonetheless, there are many challenges to be overcome in order to achieve a long-term growth. In this article we analyze the current situation of Brazil, focusing on the eCommerce evolution and the main advantages and challenges that the industry will have face.

The Brazilian economy is at a tipping point. Consumers and industry’s trust indicators are high, the country risk decreased, the GPA is growing again and the capital market is more active than ever. However, there are many challenges in the path of a long-term growth. Productivity is not growing enough and the lack of innovation and a well-trained work force are discouraging factors.

Ecommerce in Brazil

Despite all discouraging factors already mentioned, there is a highly dynamic sector in Brazil that presents clear signs of growth: the digital world. According to the new McKinsey&Co report, the conditions for a digital disruption are given in Brazil and consumers are prepared for it. These are some of the main conditions:

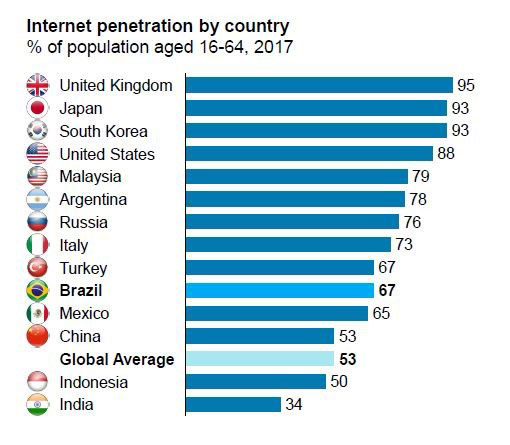

- Internet penetration already was 17% above the global average by 2017

- More than 2/3 of the population has access to a smart phone and the internet

- Brazilians spend more than 9 hours online (one of the highest rates)

- Brazil in between the 3 mains countries regarding the usage of social media and online platforms such as Netflix, Youtube and Whatsapp

- Digital advertisement grows at double digit

- Collaborative economy, delivery and eCommerce are growing at a fast rate. Projections indicate that sharing economy will grow a 2000% from 2015 to 2025, led by Brazil, Argentina and Mexico

Internet access and its extended use creates the bases for the takeoff of online platforms and sales. Moreover, an active use of social media creates a great environment for online advertisement. Once again, this growth presents its challenges and it needs to be boosted with investments and the optimization of segments that still need to catch up. For example, the internet speed in Brazil is still lower than the average of the developed and emerging markets. Besides, eCommerce penetration is at an incipient point and, despite the great usage of digital media, online transactions are still relatively low.

Payments

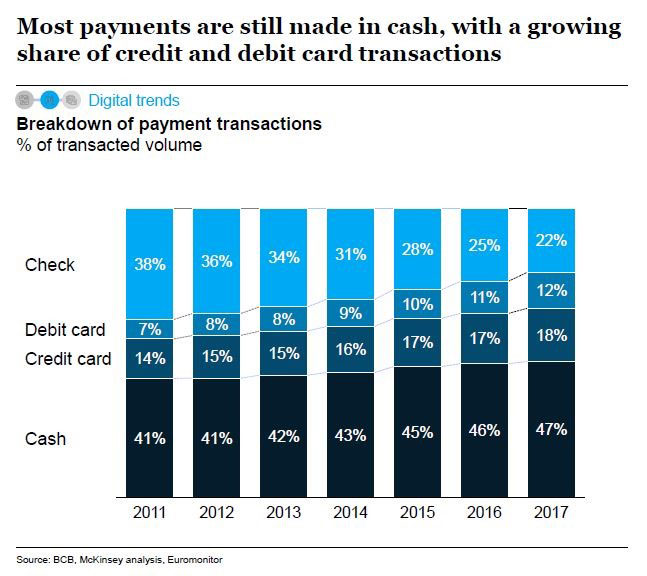

In the payments area, Brazil faces the challenge of having a low bancarization rate -a 25% of the population does not posses a bank account. Nonetheless, this tendency is declining since 33% of the population did not have a bank account at 2014 and Brazil possess the highest bancarization rate of LATAM. Despite the fact that most payments are still made in cash, the share of payments in debit and credit card is on the rise. This situation stimulates eCommerce, since the chances to buy online are less limited to payment options.

Currently, almost all CPG platforms in Brazil accept credit cards payments. However, cash and debit payments are available in only the 40% of retails, while around the 55% offer a cash payment option in an external terminal. Therefore, retails must focus on the expansion of their payment methods in order to reach to potential clients. The expansion of bancarization will make a huge contribution to the retails’ efforts.

Sales categories

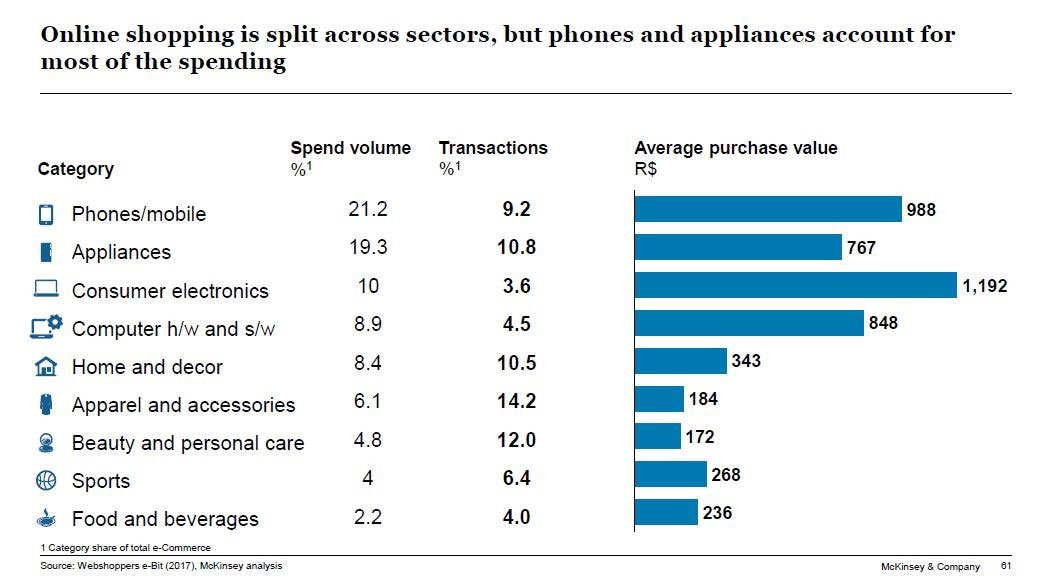

Brazil presents a tendency similar to that of neighboring countries, regarding online sales. CPG categories are not the most developed, however, they are growing online 5 times faster than in other channels. The distinctive sign of Brazil is that it presents a huge market for Beauty and Personal Care products, with an average percentage 3 times higher to the one of Food and Beverages. The online penetration of this category already represents the 3% of retails’ total sales.

It is worth noting that the online availability of these products is increasing due to the expansion of the presence of supermarkets in last mile platforms. On one hand, Rappi, the Colombian start up, already posses more than 8000 users, operates in 15 cities and invested USD220 million during 2018. Uber Eats, on the other hand, has presence in more than 30 cities, invested USD480 million globally in 2018 and grew 200% since its launching in 2017. Even though this Uber service provides delivery services for restaurants, it is expected to expand to other sectors and to incorporate supermarkets within their stores, as they already did in Chile..

The increasing importance of the Last Mile is reflected in the investments made in the region. In Brazil, Grupo Pao de Açúcar, acquired James Delivery, while Walmart did the same with Cornershop in Chile. Also, some retails created solutions through their own platforms -like Jumbo did in Chile or Grupo Casino in Colombia. This showed the need that the industry had to find efficient solutions for online purchases and home delivery. In 2018 was a particularly important year for the development of this area. Finally, it is worth mentioning that eTailers – such as Amazon and Mercado Libre– that were historically exclusively dedicated to non-CPG products, started to make investment in this segment of sales. This will indefectibly implicate a different way to make deliveries.

In order to assure online success, the companies that decide to start a digitalization process, must understand the Brazilian context and the behavior of online shoppers. In the process of the digital transformation, it is essential to have a long-term plan that enable them to win online. At BeOn – eCommerce Partners we help LATAM FMCG industry to digitally transform their business by developing winning ecommerce capabilities. Our differential value offer is that we are consumer goods experts: we master the correct growth model and how to deploy it flawlessly. And our footprint covers all Latin America. Contact us to know more.