Which are the essential capabilities to win online in FMCG?

BeOn Argentina 10 JUN 2019In the last years, the scene of online sales has become increasingly more complex, and the supply chain, more fragmented. If in the traditional scheme, consumers have to go physically to the store in their free time and then take the purchase home. This changed with the disruption of eCommerce and delivery services.

Marketplaces also contributed to the diversification of the dynamic and improvement of convenience. These platforms incorporated new products and the possibility for consumers to buy directly from their favorite brands. This also gave brands the possibility to offer all their products in an online store and to connect directly with their clients.

Afterwards, new digital Last Mile platforms such as Instacart, Cornershop, Rappi and Glovo -just to name the main ones- came into scene and also completely changed the way of shopping. Similarly, to the case of Marketplaces, the amount and diversity of categories also evolved recently. Even though Last Milers started operating with the focus on delivery for restaurants, nowadays they already provide services for first class supermarket, pharmacy chains, brands and specific categories -like pet supplies- that are growing fast. Marketplaces are developing a strategy focused on FMCG with the launching of their own online supermarkets, as Mercado Libre did in some countries of the region.

If we add the Click and Collect –shopping online but picking up the order in store– to the current online scene, the industry finds itself in a completely different context than some traditional retails faced at their beginnings. This modality is more settled in the region and presents the advantage of lower costs, if compared with the home delivery option. Many supermarkets, such as Walmart, channeled the eCommerce development through the expansion of Click and Collect.

The challenge for brands and retailers is to readapt themselves to this new context and understand how to make operations more efficient and guarantee a long-term digital transformation. In order to do so, understanding the behaviors of each category and variations through the different channels will be a must.

What platforms are winning online?

eCommerce is an important growth engine for the CPG industry. This channel contributes in a 12% of total omnichannel sales. However, if we analyze growth instead of sales, eCommerce accounts for a 64%. Amazon plays an important part on it, and is responsible for more than half of that percentage. It is followed by Walmart (7%), Chewy.com (4%), Instacart (3%), Target (2%), and others. Walmart though, presented a great growth during the last months, which situated it as one of Amazon’s main competitors.

What categories sell the most online?

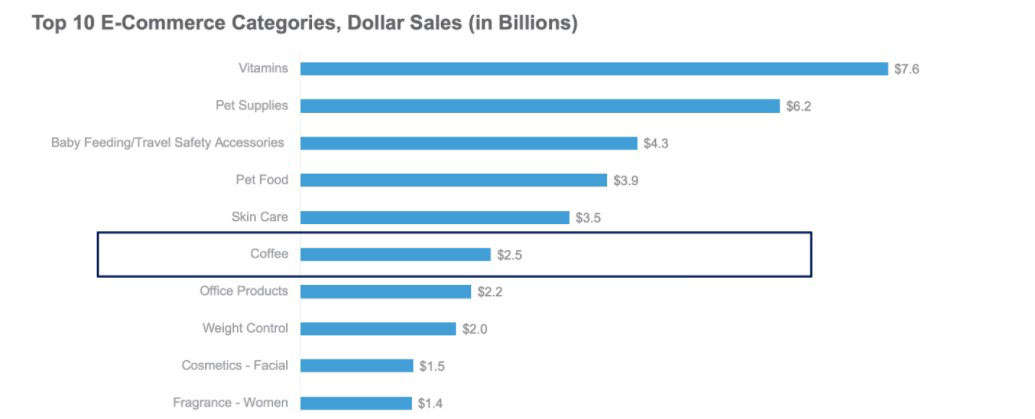

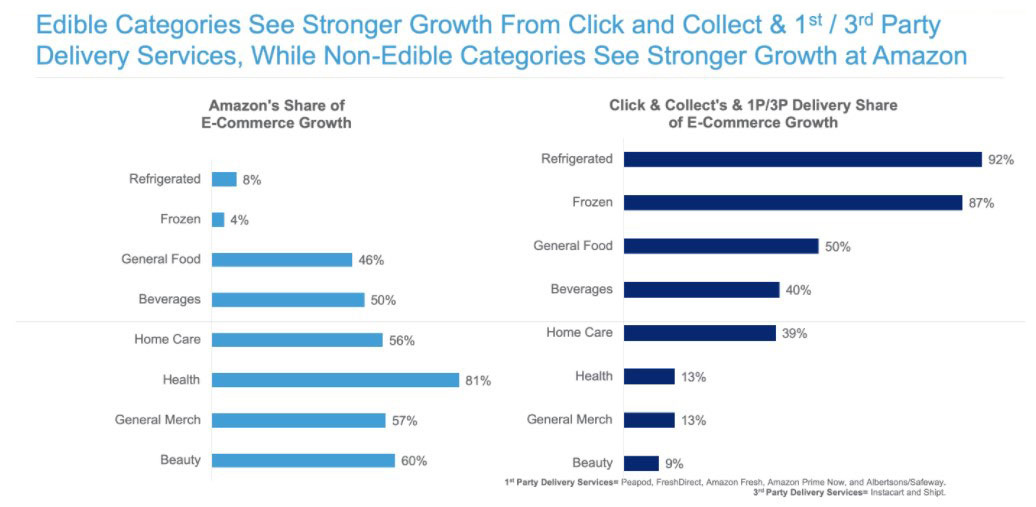

In order to better understand the current situation of FMCG industry, it is important to take into account the behavior of sales according to each category and channel of distribution. For example, in FMCG sales, non-edible categories are the online best sellers at a global scope, but edibles are preferred if we reduce the analysis to Pick up services.

As it can be seen in the graphic, the most sold category was vitamins, followed by pet supplies, baby food, pet food, skin care, coffee, office supplies, weigh control, cosmetics and facial care, and women fragances. Only 1 out of 10 categories is an edible product. This kind of information is relevant and should be taken into account for the confection of online strategies.

It is also worth noting that when Pet supplies and pet food are combined, the total number outstrips the first category. Online sales services for pet products flourished, particularly during last year. In Latin America, the major expansion took place at Last Milers, which incorporated exclusive stores and categories for this segment of the industry. The convenience generated by, for example, having the chance to buy pet food online and receive it at home instead of having to carry heavy packages, was really well captured by these platforms.

Nevertheless, when we analyze eCommerce but differentiating home delivery from Pick Up, some interesting details come up. Within CPG, edibles are preferred over non-edible products at Click and Collect.

Click and collect

Click and collect -buy online and pick up at store- is becoming increasingly popular. As we noted before, this means lower costs for retails -not only because they avoid the high costs and complexity of home delivery- but also for customers, who can collect their orders for free, in some cases, without leaving their cars and with more flexible time ranges.

Buying online and collecting in store become an attractive option for consumers and it is gaining acceptance, particularly when purchasing edible products. Click and Collect CAGR growth -from 2015 to 2018- was of 46%. If total sales represented $1.6 billion in 2015, in 2018 it reached $8.8 billion.

Additionally, FMCG sales are growing in Last Mile platforms. According to information provided by Glovo Argentina, 33% of orders proceeded from b, kiosks and pharmacies. Last Milers constantly seek to promote the acceptance of this modality throughout discounts and new alliances.

FMCG industry is, without doubts, growing fast in the online channel. Brands should pay attention to innovation and tendencies in order to build better business strategies and to seize all the growth opportunities in order to win the online race.